Yesterday was March Option Expiration day and it is time to review the movements done following our strategy.

|

| Ibex 35 on March 15th. Source Investing |

After a very quiet month, today´s gains make the March future close at 9330 points, gaining 200 points this month (or + 2,19%).

As this value is above the strike price of the sold option (which was 9100) I get to keep all the credit initially received (+ 123,35 €).

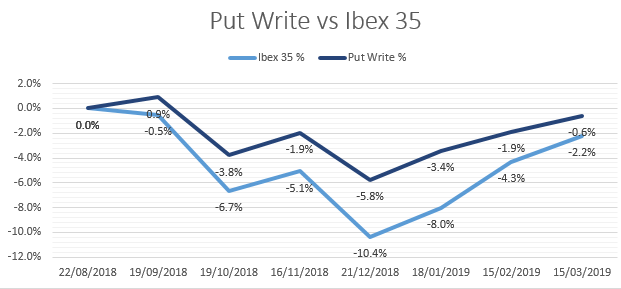

Considering this, since its inception, the Put Write Strategy is at -0,6%.

Movements and results so far

I started on August 22nd 2018 selling a 9500 September 2018 Put with the IBEX at 9540. This value will be used as base value from now on.

So, considering this seventh month, this is the comparison between the strategy and the Ibex 35 index:

Portfolio

No other position is open right now.

Resources

No comments:

Post a Comment